Kickstart your savings adventure with voluntary contributions.

•

Hybrid Retirement Plan

Kickstart your savings adventure with voluntary contributions.

Retirement might feel like a distant dream, but putting off saving now could push your goals further away. So why wait?

You're ready to go! Enjoy the perks of employer matching contributions and tax savings with every paycheck.

•

Opt for a 4 percent voluntary contribution to your Hybrid 457 Deferred Compensation Plan to unlock the full 2.5 percent employer match.

•

Once you've set this up, your chosen contribution amount kicks in the next available pay period after the quarter following your VRS enrollment.

•

If you want to change your voluntary contribution before your employer reports your VRS enrollment, simply repeat this process. The election active at the time of your VRS enrollment will be shared with your employer.

Learn more.

•

Why You Should Save with Voluntary Contributions

•

How to Set Up Beneficiaries for Your Account

•

Explore Your Investment Options

Important Reminders

•

Required? Received a Welcome Letter from Voya Financial? Log Into Your Hybrid 457 Account to Elect Voluntary Contributions.

Virginia Supplemental Retirement Plan

A 401(a) defined contribution plan for eligible personnel in participating school divisions hired on or after January 1, 2014.

Jump start your financial future, today.

Log in now to take advantage of all your Virginia Supplemental Retirement Plan benefits and help realize your retirement goals.

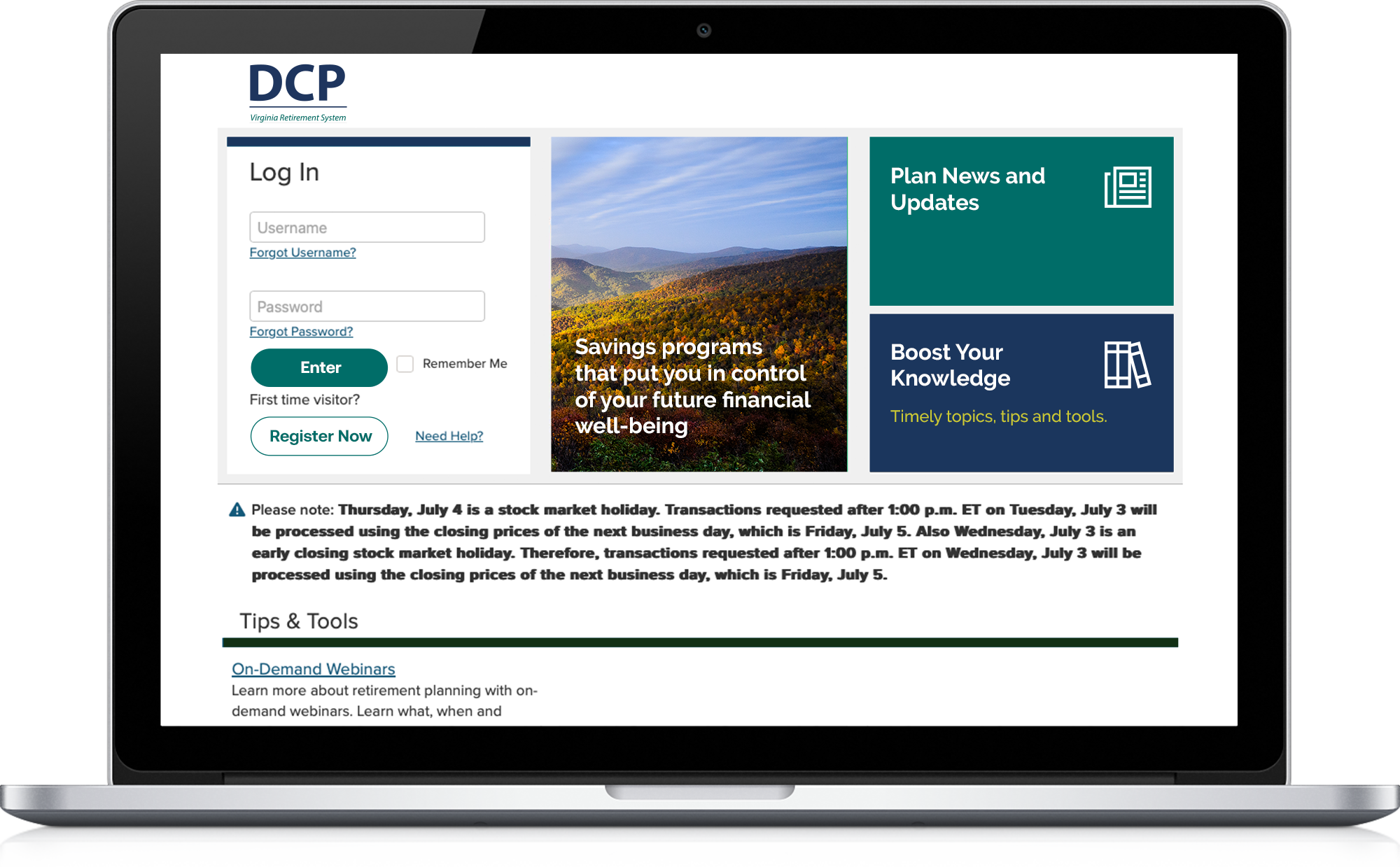

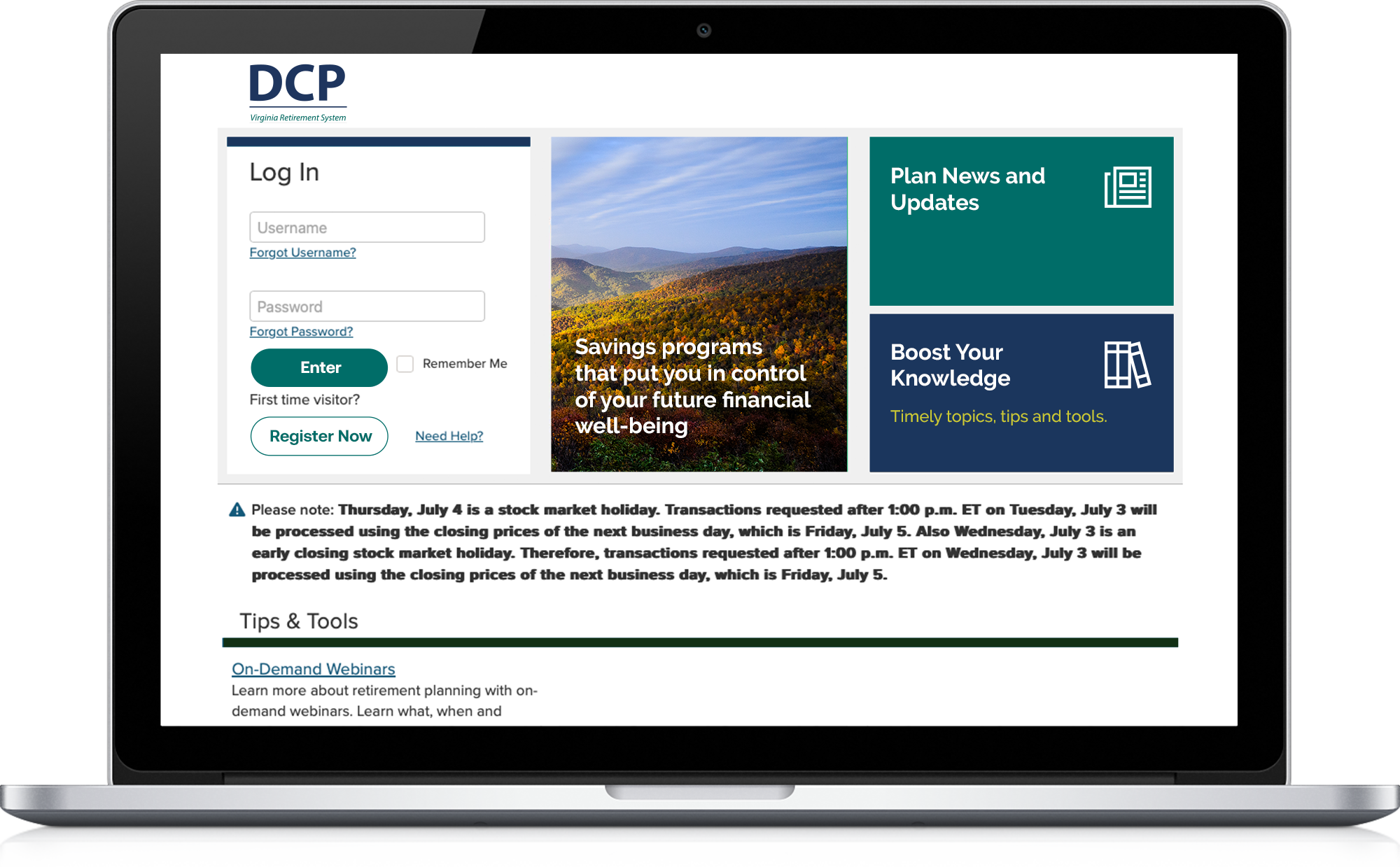

DCP Account

Get to know the plan

Eligibility

How to enroll

How to contribute

Investment options

Withdrawing money

Naming beneficiaries

Statements and confirmations

Fees and expenses

Leaving employment

ORP for School Superintendents

Optional retirement plan for school superintendents in participating school divisions.

Jump start your financial future, today.

Enroll now in the Optional Retirement Plan for School Superintendents (ORPSS) to help realize your retirement goals. If you are already saving, take action to manage your account.

DCP Account

Get to know the plan

Eligibility

How to enroll

How to contribute

Investment options

Withdrawing money

Statements and confirmations

Fees and expenses

Leaving employment

ORP for Higher Education

Optional retirement plan for higher education institution personnel engaged in teaching, administration or research.

Jump start your financial future, today.

Enroll now in the Optional Retirement Plan for Higher Education (ORPHE) to help realize your retirement goals. If you are already saving, take action to manage your account.

DCP Account

Get to know the plan

Eligibility

How to enroll

How to contribute

Investment options

Withdrawing money

Naming beneficiaries

Statements and confirmations

Fees and expenses

Leaving employment

Hybrid Retirement Plan

The hybrid plan combines elements of a traditional defined benefit (DB) pension plan and a defined contribution (DC) plan that is similar to a 401(k).

It’s important to understand both components of your hybrid plan before we go into more specifics on the VRS Defined Contribution Plan (DCP) component.

Defined Benefit

- Provides the foundation of your future retirement benefit when you qualify.

- Pays a lifetime monthly retirement benefit based on age, total service credit and average final compensation.

- VRS manages the investments and related risk for this component.

Get more information on the Hybrid Plan Defined Benefit Component at varetire.org/hybrid.

Defined Contribution

- Provides a tax-deferred savings plan in addition to your defined benefit pension.

- Provides a balance to draw from during retirement. Your balance is based on contributions by you and your employer to the plan and the investment performance of those contributions.

- You manage the investments and related risk for this component.

Jump start your financial future, today.

Log in now to the DCP component of your Hybrid Retirement Plan to help realize your retirement goals. If you are already saving, take action to manage your account.

DCP Account