COV 457 Deferred Compensation Plan

A supplemental plan, available through participating employers, that allows you to save for retirement on a before-tax or after-tax basis through convenient payroll deductions.

Jump start your financial future, today.

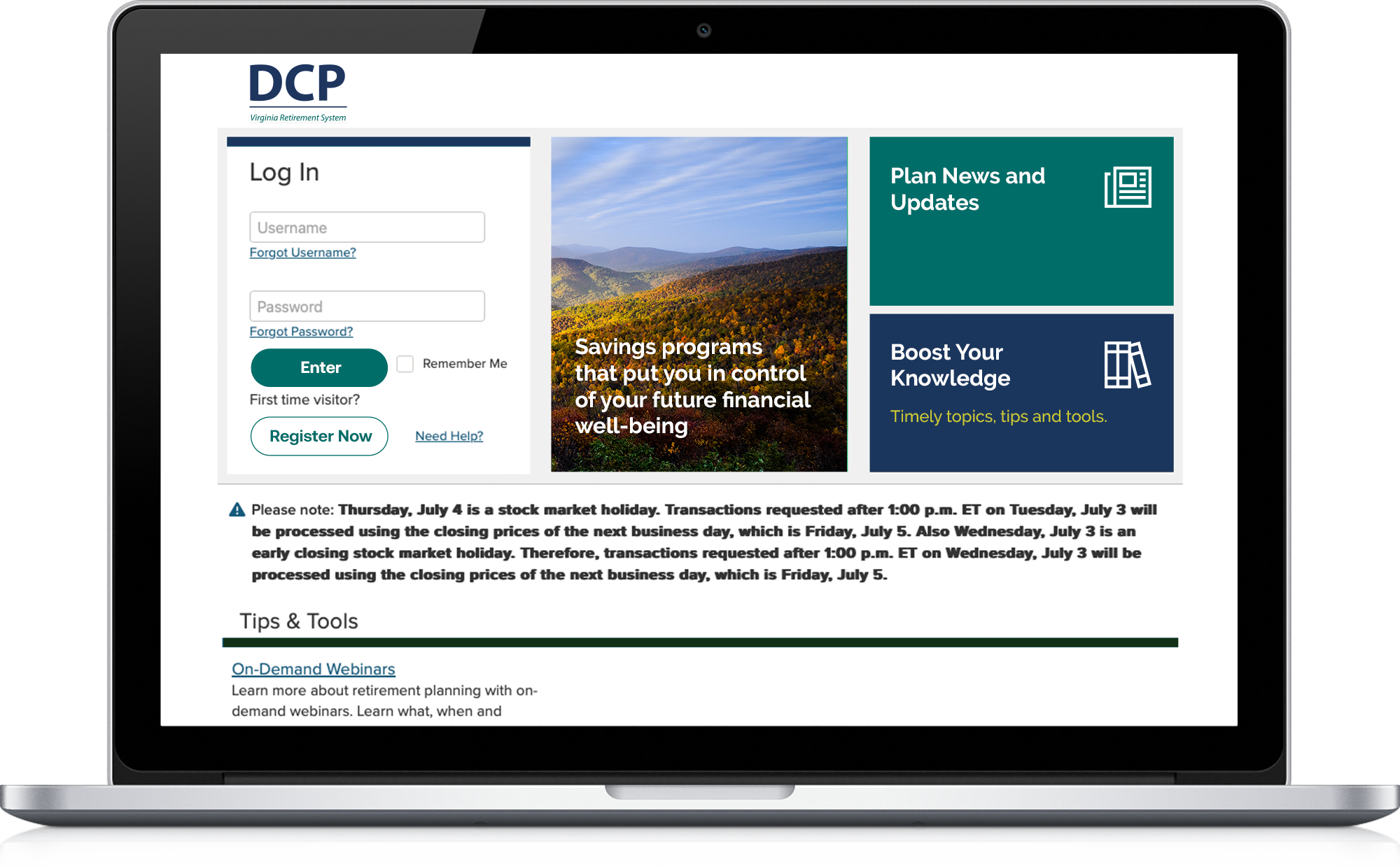

Log in now to take advantage of all your COV 457 Deferred Compensation Plan benefits and help realize your retirement goals.

DCP Account

Get to know the plan

Eligibility

Salaried and wage state employees, and employees of participating political subdivisions and school divisions.

Review the Participating Employers List to see employers participating in the COV 457 Deferred Compensation Plan and those who have adopted the Virginia Cash Match Plan.

How to enroll

Most eligible employees can enroll online after registering their DCP Account.

Wage, or part-time employees who are not covered by VRS, enroll using the Wage Enrollment Form. Once completed, submit it for processing as indicated on the form. You will receive a welcome letter once your account has been established, which allows you to manage your account online.

Salaried state employees not covered by the Hybrid Retirement Plan will be automatically enrolled in the plan 90 days after your hire date at a $20.00 before-tax contribution rate. Your contributions will be deducted from your pay automatically and invested in an age-appropriate Target Date Portfolio. You can change how much you contribute and how your contributions are invested at any time.

How to contribute

You may make two types of contributions to your COV 457 Deferred Compensation Plan:

- Pre-tax contributions: You pay taxes on these contributions later, which lowers your taxable income now.

- Roth (after-tax) contributions: You pay taxes on these contributions now and make tax-free withdrawals later, if certain criteria are met.

You choose a dollar amount of your eligible compensation to contribute to the plan. Your contributions are automatically deducted each pay period and deposited into your Plan account. The minimum amount you can contribute is $10 per pay period. The maximum you can contribute is 100% of includible compensation or the maximum IRS annual contribution limits*, whichever is less.

The annual limit includes any voluntary contributions that Hybrid Retirement Plan members make to the Hybrid 457 Deferred Compensation Plan or another supplemental 457 plan through your employer. Any Roth or pre-tax contributions made to the COV 457 Deferred Compensation Plan also count toward the limit.

Log in to your DCP Account at dcp.varetire.org/login to begin making contributions or learn more in Your Plan Guide: COV 457.

SmartStep

Increasing your contributions on a regular basis may help you reach your savings goals faster. The SmartStep contribution rate escalator can automatically increase your contributions on a schedule you select. You also choose the increase percentage. You can change the frequency and percentage, or turn off the feature as desired.

Learn more about this feature or log in to your DCP Account at dcp.varetire.org/login to choose SmartStep now.

Military Leave Make-Up

If you leave your position for military service, you cannot contribute to the COV 457 Deferred Compensation Plan unless you continue to receive compensation from a covered position. If you return to salaried or wage employment with an employer that offers the plan and meet the requirements of the Uniformed Services Employment and Reemployment Rights Act of 1994 (USERRA), you may contribute the amount of deferrals you were unable to make during your period of military leave, even if you were not making contributions previously. If applicable, you will also receive the employer cash match on these make-up contributions. To learn more, review the Application for Uniformed Service Leave Make-Up and Payroll Authorization Form.

Age 50+ Catch-Up

If you are age 50 or older during the calendar year, you may contribute an additional amount over the regular IRS annual contribution limit to the 457 Plan.*

Super Catch-Up Ages 60 to 63

If you are age 60, 61, 62 or 63 during the calendar year, you may contribute the greater of $10,000 or 50% more than the regular age 50 catch-up amount in 2026*. After age 63, the standard age 50+ catch-up limits will apply.

Standard Catch-Up

During each of the three calendar years before normal retirement age, COV 457 Deferred Compensation Plan participants may contribute up to twice the regular IRS annual contribution limit, or the regular annual limit plus the amount of the standard catch-up credit, whichever is less. The standard catch-up credit is the amount participants were eligible to contribute but did not contribute in previous years. To learn more about eligibility for this provision, review the Standard Catch-up Form.

*See IRS Contribution Limits section drop down for the 2026 annual IRS contribution limits.

Effective January 1, 2026, age-based catch-up contributions for certain higher-income participants must be made as Roth after-tax contributions. Specifically, if your FICA wages (box 3 of your W-2) from the previous calendar year exceeded $150,000, (subject to annual cost-of-living adjustments), any age-based catch-up contributions you make must be designated as Roth after-tax contributions and your pre-tax contributions cannot exceed $24,500 across any 457 plans you are eligible to participate in. To learn more about this provision, read the Catch-up Contributions Flyer.

IRS Contribution Limits

2026 Deferred Compensation Plans Annual Contribution Limits:

- Age 49 and under = $24,500

- Age 50+ catch-up = Additional $8,000 (maximum contribution of $32,500)

- Super catch-up ages 60 to 63 = Additional $11,250 (maximum contribution of $35,750)

- Standard catch-up (not to exceed participant’s catch-up credit) = Up to an additional $24,500 (maximum contribution of $49,000)

Catch-up contribution limits cannot be combined.

Effective January 1, 2026, age-based catch-up contributions for certain higher-income participants must be made as Roth after-tax contributions. Specifically, if your FICA wages (box 3 of your W-2) from the previous calendar year exceeded $150,000, (subject to annual cost-of-living adjustments), any age-based catch-up contributions you make must be designated as Roth after-tax contributions and your pre-tax contributions cannot exceed $24,500 across any 457 plans you are eligible to participate in. To learn more about this provision, read the Catch-up Contributions Flyer.

If you are subject to the above requirement and you are eligible for an age-based catch-up in the same year you have been approved to use the standard catch-up, you may use higher of the two limits. If your available catch-up credit is less than the age-based catch-up amount, you may continue to use pre-tax contributions up to the amount of your available credit, but additional contributions up to the age-based limit must be made to a Roth. If you are a VRS Hybrid Retirement Plan member, your voluntary contributions in that plan count toward the annual 457 contribution limits referenced above, including the COV 457 Deferred Compensation Plan or any other 457 plan that may be offered directly by your employer. If you reach the limit before the end of the year, both your contributions and the associated employer match will stop.

For Hybrid Retirement Plan members, voluntary contributions can only be made on a pre-tax basis, so planning ahead is crucial to ensure your contributions continue throughout the year. First, determine the dollar amount of your voluntary contributions for the year. Then, subtract that amount from the normal elective deferral limit to determine how much you can still contribute through a supplemental plan.

Investment options

The plan offers a variety of investment options—from pre-mixed target date portfolios to a menu of options across asset classes—to construct your investment portfolio. If you do not make investment elections, your account will be automatically invested in an age-appropriate target date portfolio. More information about the options is available online or by calling toll-free 877-327-5261.

Additionally, the plan offers a Self-Directed Brokerage Account (SDBA) through Charles Schwab. Publicly traded mutual funds, exchange-traded funds (ETFs) and individual securities are offered through the SDBA. You must a have an initial balance of $3,500 in your account to open an SDBA and you must maintain a minimum balance of $2,500 in investments within the other two pathways. Transfers into the SDBA must be made in minimum increments of $1,000. If you have any questions about the brokerage account, please contact Charles Schwab at 888-393-7272, Monday through Friday, 8 a.m. to 7:30 p.m., excluding market holidays.

Please consider the investment objectives, risks, fees and expenses carefully before investing.

Charles Schwab & Co., Inc. and Voya Financial are not affiliated and are not responsible for the products and services provided by the other. Schwab Personal Choice Retirement Account® (PCRA) is offered through Charles Schwab & Co., Inc. (Member SIPC), the registered broker/dealer, which also provides other brokerage and custody services to its customers.

Withdrawing money

You may withdraw from your account only when you meet one of these conditions:

- Terminate employment from the employer that offers the plan, and your current employer does not offer this plan. You must also meet the break-in-service requirement of one full calendar month.

- Use your plan account to purchase VRS service credit, if approved.

- Experience an unforeseeable emergency that is approved by the Plan Administrator.

- Reach age 70½, even if still employed.

- Rolled funds from another retirement plan into your COV 457 Plan account.

- Rolled pre-tax dollars from your account into a Roth account.

To be eligible for tax-free withdrawals from a Roth account, the account must have been open for at least five years and you must be age 59½ or older or disabled. In addition, the rules governing distribution provisions in this Plan may be different from the distribution provision rules from which rollover money originated. The Plan withholding rules for distributions may apply to rollover money from other Plans.

Naming beneficiaries

Your beneficiary is the person (or persons or entities such as a trust or estate) who will receive your account value in the event of your death. It’s important to have the right beneficiary listed and to occasionally review your choice, particularly after major life events such as marriage, the birth of a child or a divorce. Designate your beneficiary by logging in to your DCP Account at dcp.varetire.org/login and selecting Personal Information > Beneficiary Information.

Statements and confirmations

Account statements generate quarterly and post to your online account and Voya Retire® mobile app. You will receive an email to let you know it’s available. If you elected to receive communication via U.S. mail or do not have an email on file, you will receive your quarterly statements via U.S. mail.

You can access your account statements at any time by logging in to your Commonwealth of Virginia 457 Plan Account at dcp.varetire.org/login and selecting Statements and Documents. You can also view them in the way that makes the most sense to you. Enter a specific date range and generate a statement view for that period, selecting the information you would like to see on the statement.

Review this guide to understanding your Voya® account statement.

Also, any time you make a transaction, either through the website, the Voya Retire mobile app or the Voya customer service center, a confirmation statement is generated and posted to your online account/Voya Retire mobile app. If you elected to receive communication via U.S. mail or do not have an email on file, you will receive your confirmation via U.S. mail.

Fees and expenses

The following expenses are associated with participating in the plan:

- Annual plan administration fee: Voya will deduct an annual per participant fee of $35.50 ($2.96 deducted monthly for 11 months, then $2.94 deducted in the last month). This is the total fee for Voya’s record-keeping services and the cost of plan administration. If you participate in more than one Commonwealth of Virginia plan, you will pay only one annual record-keeping fee of $35.50.

- Investment management fees and other fund expenses: These fees cover a fund’s management and operations, including advisory, trading, custody and accounting activities. Investment management and other fund expenses are deducted from each fund’s investment return.

- Expedited check delivery fee: A fee of $50 will be charged for any expedited check delivery.

- Financial planning services fee: A fee of $175 will be charged for each financial plan analysis. Get more information at dcp.varetire.org/education/financial-planning.

- Advisory services fee: Enrolling in the Professional Management program incurs an extra yearly fee up to 0.40%, depending on your account balance. Get more information at dcp.varetire.org/education/advisory-services.

Leaving employment

You do not have to take your money out of the COV 457 Deferred Compensation Plan when you retire or terminate employment. You can leave your money in the plan until you are age 73, when you are required to take minimum distributions. Keeping your money in your account may provide you with potentially more cost-effective retirement opportunities than rolling your money into a traditional IRA.

Why keep your assets in the plan? Take time to learn about your options in the Leaving Employment Guide.

Distribution Options

The COV 457 Deferred Compensation Plan offers a variety of distribution options to suit your needs. Most distribution options can be changed at any time and include the following:

- Full lump-sum distribution

- Partial lump-sum distribution

- Periodic payments (monthly, quarterly, semi-annually or annually)

- Partial lump-sum distribution and periodic payments

- Roth installment distribution

- Rollover into an eligible retirement plan such as a 401(a), 401(k), 403(b), governmental 457(b), traditional IRA or Federal Employees Thrift Savings Plan that accepts such rollovers.

- Annuitization (Contact MetLife at 866-438-6477, or an alternative provider, to arrange for the purchase of annuity. Please consult with a financial advisor and tax professional to see if an annuity is right for you.)

Note: If you have money in the Self-Directed Brokerage Account (SDBA) or Virginia Retirement Investment Portfolio (VRSIP), you must move the monies to a core investment fund prior to your withdrawal request. If you do not do this, your distribution will be processed from the amount that is available in the core investment funds in excess of the core minimum.

To be eligible for tax-free withdrawals from a Roth account, the account must have been open for at least five years and you must be age 59½ or older or disabled.

The rules governing distribution provisions in this plan may be different from the distribution provision rules from which rollover money originated. The plan withholding rules for distributions may apply to rollover money from other plans.

News and insights

Focus Newsletters

Get the latest news and insights on your VRS Defined Contribution Plans.

Need Help?

Locate and contact your DC Plans Education Specialist to schedule one-on-one counseling.

Navigating Market Volatility

Learn how to better navigate the ups and downs of today's markets.

Stay Connected

Download the Voya Retire® mobile app to manage your account and boost investment knowledge on the go.

Historical Records

Access past statements and tax forms from the MissionSquare Retirement website.